Marketplace lending, also called crowdlending and P2P lending, is an alternative financing method that provides borrowers access to capital from a group of investors.

A marketplace lending platform plays the role of a marketplace where borrowers can present their projects to potential investors to acquire funds.

The rise of different marketplace lending platforms increased the question of whether it contributes to financial inclusion in local or global societies.

Financial inclusion stands for easy access to affordable financial products and services that match the financial requirements of individuals and businesses (transactions, payments, savings, credit and insurance, etc).

On the contrary, financial exclusion is when individuals or companies encounter difficulties in accessing or using those financial services and products, enabling them to lead an everyday social life in their society (European Commission 2018).

The features of marketplace lending allow it to create digital financial inclusion.

The main idea behind marketplace lending is to channel the funds collected from investors into parties in need of funding. And by doing so, it replaces the need to rely on traditional financing institutions to acquire funds, thus creating financial inclusion for borrowers, both individuals and businesses.

Additionally, marketplace lending was not designed to address particular social categories of people. It is meant to create an equal chance for individuals and businesses to gain access to capital, fund their projects and be part of the financial cycle of their markets.

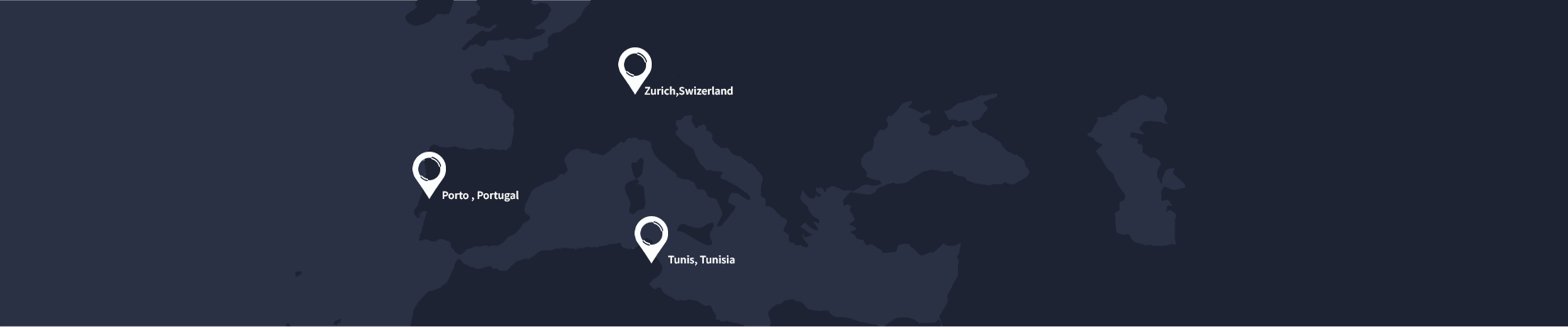

Another feature of marketplace lending is that it is borderless.

Marketplace lending platforms are digital marketplaces. Their reliance on the internet for advertising projects and collecting funds play an essential role in removing any obstacles of location. It also enables individuals and SMEs to raise funds from alternative sources with the possibility to apply for loans anytime.

Compared to traditional ways of financing, marketplace lending can contribute to financial inclusion by trusting the cost-effectiveness of its procedures during many phases of loan obtention. It can also generate good returns for investors, although it might come with higher risks.

Ultimately, marketplace lending’s ability to encompass more businesses and individuals, who conventional financial institutions exclude, makes it a worthy substitute for traditional forms of financing.

Keep reading

Curious to know more? Check out the rest

of our blogs

Watch our YouTube Channel

This channel will cover the Crowdlending industry!

Our mission is to provide you with all the insights

from this market and help you make informed decisions.

Speak to our awesome team

Please feel free to leave us a message here or call us directly. Our expert support team is here to help you!