FAQs: Need help?

Quick answers to your questions

-

For investments in loans, Acredius has a success-based fee of 1% per repayment. These 1% are currently given back to you as a bonus.

For investments in equity, Acredius only benefits when an investor reaps a return on their investment: We succeed when you succeed! Acredius receives a performance-based profit share, known as the "Carry fee", equal to 16.75% of the amounts distributed to the investors. -

Any person of legal age and legal capacity can invest.

-

No, European residency is not required to invest. Investors residing outside of Europe can also participate in projects on our platform. The only exceptions is investors from the USA, who, due to regulatory restrictions, cannot invest through Acredius.

-

The key investment information sheet is a document available on the client space and presenting information about the project in need of funds as well as the project owner. The selected information guides potential investors through the relevant insights needed prior to taking an investment decision.

-

In the event of the company's bankruptcy, it is possible that the invested capital may not be returned as initially anticipated. In the most unfavorable scenario, there may be a complete loss of the invested capital. Therefore, it is advisable to invest only an amount that you can comfortably afford to lose in case of a potential total loss. All risk types are further detailed in the KIIS.

-

At this time, Acredius does not provide a secondary market.

-

We offer a complaint management system that allows you to easily and precisely submit complaints in compliance with legal standards. You can find the complaint section in your client space under the “Settings” section.

-

If you are categorized as a non-sophisticated investor (following a questionnaire that you will need to complete prior investing), you will have the option to withdraw your bid within 4 days after receiving investment confirmation. To do so, you can use the "Revoke Investment" button located on your investor dashboard.

-

At the end of the fundraising campaign, if the target amount is not reached, subscribers will be fully refunded without any fees. Alternatively, the campaign will be extended.

-

The campaign lasts 30 days, which can be extended.

-

You can invest as little as EUR 200 for loans and EUR 1’000 for equity.

-

You can log in to your account by clicking on the "Login" button (on the top right corner of the Acredius website) and by typing in the email address and password you have used to create your account.

-

Yes, certainly! Please contact us at info(at)acredius.com, and one of our representatives will contact you to arrange a meeting at the office.

-

Acredius AG was established in 2017.

-

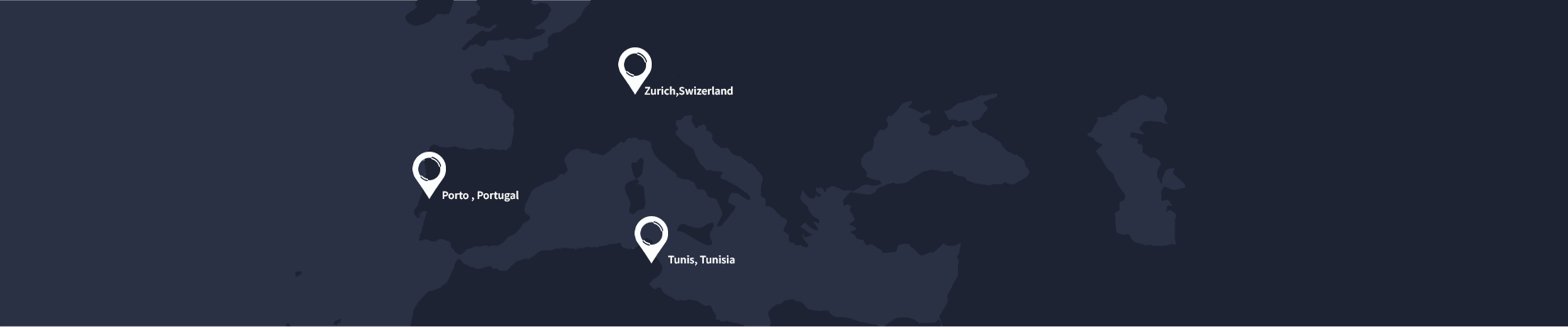

We have an international team of 20+ talented members.

-

One of Acredius' strategic and financial partners is Mangopay. They are responsible for performing the loan and equity servicing.

-

We’re home to investors from all over the world and accept all major international currencies.

-

Yes, our pool of investors also includes institutional investors.

-

No, on the lending side we offer monthly amortised loans. This means the repayments of principal and interest occur every month of the project duration.

-

Here is the story of Definition 12

And the story of Mybox -

Currently, there are private investors in the Acredius network - which account for the majority of the investors, as well as institutional investors, family offices, funds and high net worth individuals.

-

Yes, we have a referral programme at Acredius. Existing users can share their referral links with friends, and when those friends sign up and create their wallets, both the existing user and the friend will be eligible to earn a bonus. There is no limit to the number of referrals you can make, so the more friends you refer, the more rewards you can receive. Further details can be found in your client space.

-

It will take you 2-5min to register and initiate your wallet creation (assuming you have the relevant documents at hand). Then, the finalisation of your wallet creation can take 24-48h.

-

Depending on the project and risk class, annual nominal interest rates usually range from 2 to 15%.

-

You can decide on which documents you wish to publish on the project page. Only registered investors will have access to these. Besides a key investment information sheet (KIIS) you will need to fill, we highly invite you to share your pitch deck. These documents are usually needed to guide investors in their decision making. Registered investors can eventually request to review additional information to assess the investment opportunity.

-

You can log in to your account by clicking on the "Login" button (on the top right corner of the Acredius website) and by typing in the email address and password you have used to create your account.

-

Yes, certainly! Please contact us at info(at)acredius.com, and one of our representatives will contact you to arrange a meeting at the office.

-

Acredius AG was established in 2017.

-

We have an international team of 20+ talented members.

-

We recommend creating a title that best represents your business and which includes the name of your business, e.g. "Cutting edge drone - Company Inc''. With that being said, once you create your title, our team will review it and will suggest potential amendments.

-

Yes, our team will review the title and description of your credit application and advise on potential amendments.

-

An exact time can not be guaranteed, as the investors solely decide whether or not they are interested in the project. However, we have seen various scenarios of credits financed within weeks as well as longer durations.

-

On the Acredius platform, you can not have a borrower as well as an investor's account. Therefore, we encourage you to register only with the one based on your current needs and interests.

-

You do not have to pitch to investors. They will have the chance to know more about your business on our platform through the descriptions you have provided during the application.

-

You do not have to sign a contract with every single investor. Acredius will directly manage the relationship and the formalities with the investors.

-

The credit request stays online for a duration of 30 days. Once it expires, you may decide whether you wish to extend it for another 30 days to enable the gathering of more investors or if you want to close your request.

-

At Acredius, next to some traditional methods to gauge creditworthiness, we also use non-traditional data such as social media profiles, customer reviews, awards won and much more, to assess your case.

-

The offer displayed is indeed final. Unfortunately, a more competitive offer can not be formulated, as it would not accurately reflect the risk associated with your credit request.

-

Acredius has a success-based fee of 1% p.a. on the amount requested.

-

One of Acredius' strategic and financial partners is Mangopay. They are responsible for performing the loan and equity servicing.

-

The offer is binding from the date of the online contract signature.

-

We highly recommend avoiding over-indebtedness. Depending on the size and duration of the outstanding loans, an offer may be formulated.

-

No, you cannot get a loan offer if your business is not registered at an EU-based register of commerce.

-

Yes, receiving a loan offer at Acredius is free of charge. Keep in mind that once the project is financed, you will have to repay it with interest, including a 1% p.a. success fee to Acredius, on the amount requested.

-

The amount and duration can only be changed in the first step of the registration.

-

To see an example of a contract, in which the terms of the contract are stated - please contact one of our representatives for your region.

-

We strongly recommend the borrowers to share the company's balance sheet from the last 3 years, to better assess the interest rate. More documents can be from marketing or awards the company has received. These can be uploaded under "marketing documents" or "others".

-

Yes, our pool of investors also includes institutional investors.

-

No, on the lending side we offer monthly amortised loans. This means the repayments of principal and interest occur every month of the project duration.

-

The first month after you have successfully received the loan.

-

No, on the Crowdlending side, we currently offer term loans. However, we have a second pillar offering Private Equity fundraising and convertible loans.

-

To receive a loan offer, the borrower has to go through a three-step process.

1) First, tell us your needs (amount sought and duration) and create your borrower account.

2) The documents should be uploaded to be reviewed and assessed, with the company's financials being the most important ones. Keep in mind that these documents remain confidential.

3) Finally, pitch it to investors! You will be required to give your project a title and be asked to answer two open questions to help the investors understand and believe in your project. -

On average companies applying on the Acredius platform repay the loans in 36 to 48 months.

-

The average size of the amount requested on the Acredius platform is around EUR 200'000. However, it is possible to request up to EUR 1 million.

-

Here is the story of Definition 12

And the story of Mybox -

Currently, at Acredius, we do not require collateral to receive a loan. But in some cases the possibility will be discussed between the borrower and the Acredius team.

-

At Acredius, we are able to provide instant offers thanks to the use of Artificial intelligence. Our Machine Learning algorithms allow us to build scorecards with high accuracy.

-

Yes, we have a referral programme at Acredius. Existing users can share their referral links with friends, and when those friends sign up and create their wallets, both the existing user and the friend will be eligible to earn a bonus. There is no limit to the number of referrals you can make, so the more friends you refer, the more rewards you can receive. Further details can be found in your client space.

-

It will take you 2-5min to register and initiate your wallet creation (assuming you have the relevant documents at hand). Then, the finalisation of your wallet creation can take 24-48h.

-

Depending on the project and risk class, annual nominal interest rates usually range from 2 to 15%.

-

Acredius welcomes applications from companies registered in the EU or Switzerland seeking to raise funds on our platform.

-

Acredius allows you to raise funds ranging from EUR 300’000 to EUR 5 million through our platform.

-

Acredius applies a 13.5% success fee when your funding goal is met.

-

The decision regarding the percentage of equity to offer depends on several factors, including your fundraising target and company valuation. While the final decision is yours, we advise against offering a controlling share of your business to maintain operational control and flexibility.

-

On Acredius, your valuation should be established on a fully-diluted basis, taking into account all share options, warrants, convertible debt, and any other rights to acquire shares. Valuing your business is subjective, but we recommend commencing by researching valuations of similar businesses within your market. Additionally, consider the stage and growth of your company. It is prudent to adopt a conservative approach to valuation, as a lower valuation can attract more investors’ interests and facilitate future funding rounds.

-

For cap table preparation, ensure it is structured on a fully-diluted basis, which encompasses:

a comprehensive list of all existing shareholders and the quantity of shares held by each.

The total number of options available, including those within a share pool designated for allocation.

Provisions for shares that may be issued if convertible loans or warrants are exercised. -

For the moment we only enable non-voting shares of your company towards your investors on the Acredius platform.

-

You can decide on which documents you wish to publish on the project page. Only registered investors will have access to these. Besides a key investment information sheet (KIIS) you will need to fill, we highly invite you to share your pitch deck. These documents are usually needed to guide investors in their decision making. Registered investors can eventually request to review additional information to assess the investment opportunity.

-

On the Acredius platform, you can not have a startup account as well as an investor’s account. Therefore, we encourage you to register only with the one based on your current needs and interests.

-

An exact time can not be guaranteed, as the investors solely decide whether or not they are interested in the project. However, we have seen various scenarios of projects financed within weeks as well as longer durations.

-

1)Begin by submitting a request to raise funds through the Acredius platform. Follow the steps by furnishing all the required details and documentation about your project / startup.

2)Once submitted, the Acredius team will review your application thoroughly to ensure it aligns with our criteria and standards.

3)Upon approval, your fundraising project will be published on the Acredius platform, making it accessible to potential registered investors. The project remains active on the platform for 30 days (extendable) or until the predetermined funding goal is reached, whichever comes first.

4)Upon funding, Acredius will guide you through the necessary paperwork, in collaboration with your legal team (as needed).

5)Once completed, you will be able to retrieve the funds from your digital wallet on Acredius. -

Click here to get all needed Information

-

You can log in to your account by clicking on the "Login" button (on the top right corner of the Acredius website) and by typing in the email address and password you have used to create your account.

-

Yes, certainly! Please contact us at info(at)acredius.com, and one of our representatives will contact you to arrange a meeting at the office.

-

Acredius AG was established in 2017.

-

We have an international team of 20+ talented members.

-

One of Acredius' strategic and financial partners is Mangopay. They are responsible for performing the loan and equity servicing.